About a Simplified Paper Tax Return (簡易申告書)

Municipal and prefectural inhabitant’s taxes are levied on each taxpayer in accordance with the total amount of previous year’s income by a municipality where you have/had a registered address as of January 1 of the current year.

This simplified tax return form has been mailed to you due mainly to one of the following three reasons: (i) the Hikone Tax Division cannot verify the amount of your previous year’s total income, (ii) the Hikone Tax Division cannot confirm whether or not you are a dependent and, if so, a dependent of whom, or (iii) the Hikone Tax Division cannot confirm why you have been taxed by another municipality despite the fact that you were listed on Hikone’s Basic Residents Registration System as of January 1 of the current year.

Please have a look at “Frequently Asked Questions” as a reference when filling out the simplified tax return form should you have any questions.

For your information, your tax return plays a crucial role in calculating the accurate amount of taxes and national health insurance premiums you will required to pay as well as issuing you tax-related certificates, and receiving more public services.

Even if you earned little to no money in the past year or are/were a student, you are still required to file this simplified tax return form to the Hikone Tax Division by mail or in person.

Please accept our apology if you already completed doing your taxes at the time of reading this.

※If you need the English, Chinese, Portuguese or Vietnamese version of the simplified tax return form, please come to the Hikone Tax Division in person or see it on the website of Hikone City by scanning the QR code.

We have translated this simplified tax return form into English, Portuguese, Chinese, and Vietnamese. If you need one, please contact the Hikone Tax Division at 0749-30-6140. If you wish to contact us in English, Portuguese, Chinese or Vietnamese, please call the Hikone Human Rights Policy Division at 0749-30-6113 instead.

Note that the Chinese interpreter is available only on Tuesdays and Fridays, and the Vietnamese interpreter is available only on Tuesdays, Thursdays and Fridays.

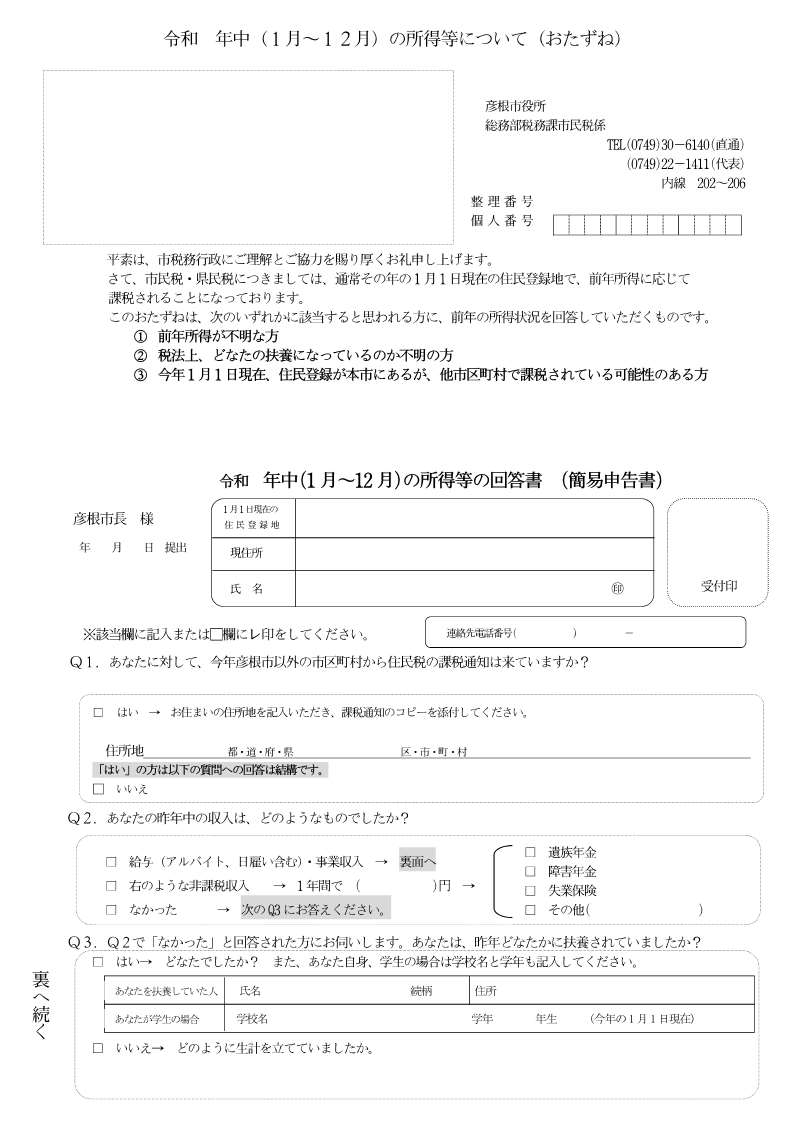

Simplified Tax Return Form

Simplified Tax Return Form (PDFファイル: 678.1KB)

Frequently Asked Questions

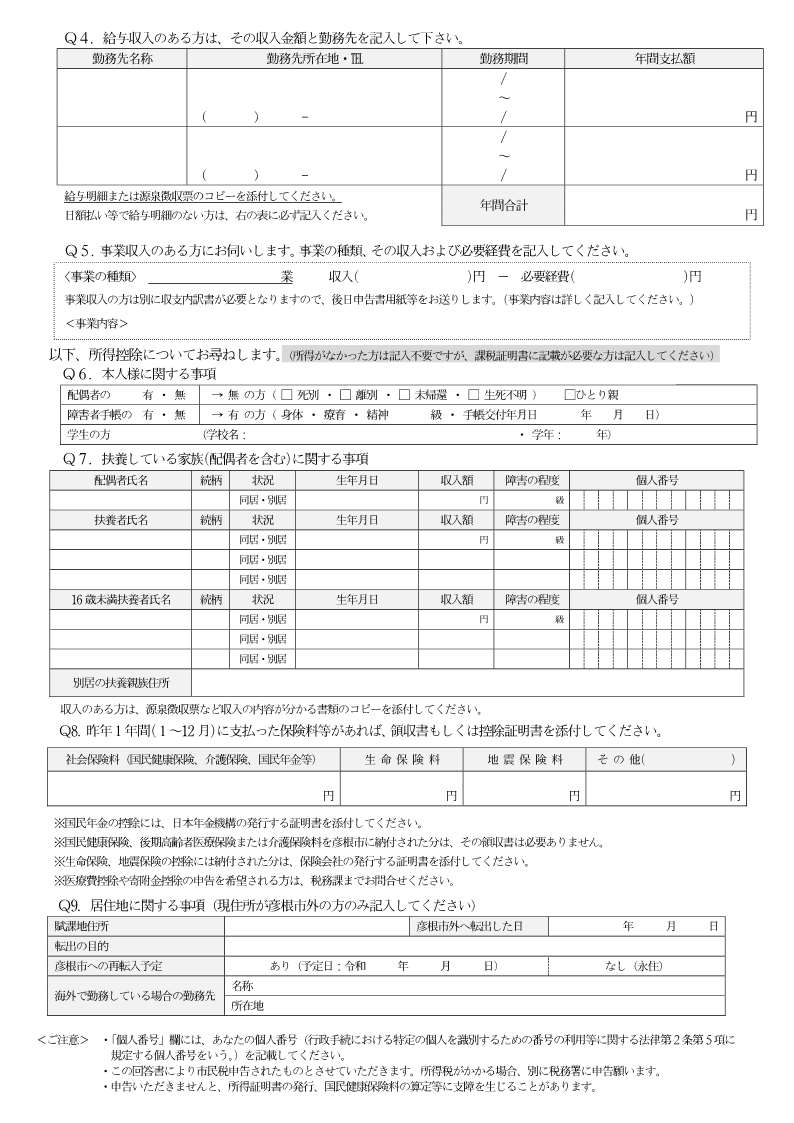

Q. What should I do if I made money as a corporate employee/self-employed person last year?

A. Please check the box“Employed (including part-time, day labor)・Self-Employed” in Question 2, and write the total amount of your previous year’s income. Please have a look at the instructions of how to fill out the simplified tax return form.

Q. Do I have to file this simplified tax return form even though I had no to little income last year?

A. Yes. This form has been mailed to anyone the Hikone Tax Division cannot confirm if he/she earned income last year.

Regardless of whether you earned money or not last year, you are still required to fill out the form and mail it back to us as it is crucial for your tax-related certificates, welfare benefits, health insurance premiums, and other public services.

Answer Question 1, and check the box “No income” in Question 2. Then provide the all information required in Question 3.

Q. I am tax-exempt as a bereavement pension/disability pension beneficiary. Do I still have to submit this form?

A. Yes. Beneficiaries of a bereavement/disability pension who are tax-exempt are still required to file their tax returns each year.

Please answer Question 1. Then check the middle box in Question 2, write the total amount of your annual pension payments, and check the pension type you are a beneficiary of.

Q. I was a dependent of my parents/family last year. Do I have to file this form?

A. Yes. Please answer Question 1 and Question 2. Then check the box “Yes” in Question 3, and write the name, relationship, and address of the person you are a dependent of.

Q. I am not living in Hikone City and have been taxed by my current local government. Should I file this form to Hikone City?

A. Please write your current address on the front of the form. Then check the box “Yes” in Question 1, and complete the rest of the form.

Q. I am working abroad and not living in Hikone City at present. Do I still have to file this form to Hikone City?

A. As long as you are registered as a resident of Hikone City, you are required to do your tax every year.

Please find someone who can fill out the form on your behalf. Be sure to write your name and that person’s name next to your name on the from. Your current overseas address needs to be provided in the address box, and add “Living aboard” at the end of the overseas address.

更新日:2024年05月23日